All Categories

Featured

Table of Contents

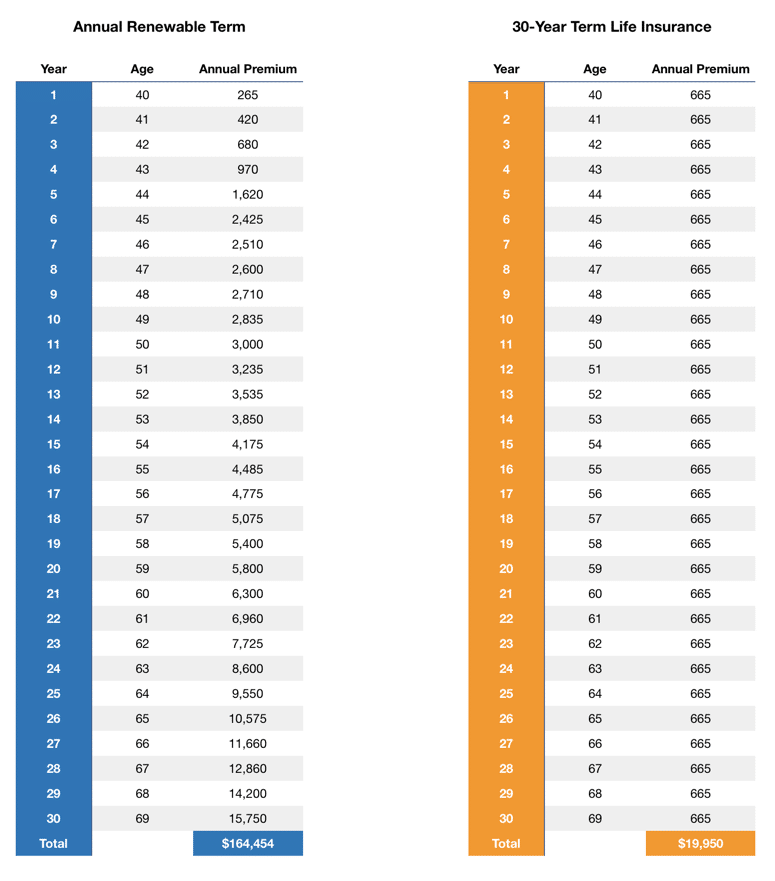

A level term life insurance coverage plan can offer you peace of mind that the individuals who rely on you will have a fatality benefit during the years that you are planning to support them. It's a means to assist look after them in the future, today. A level term life insurance policy (often called level costs term life insurance policy) plan gives protection for an established variety of years (e.g., 10 or twenty years) while maintaining the premium payments the same throughout of the plan.

Life insurance is more than just a policy; it’s a vital tool for protecting your loved ones and securing their financial future. Whether you’re looking for term life insurance to cover immediate needs or whole life insurance for lifelong security, the right policy offers peace of mind during life’s uncertainties. best term life insurance for 2025 agents. Affordable options include universal life insurance, which combines flexibility with investment opportunities, or final expense insurance, designed to cover funeral costs and related expenses

For homeowners, mortgage protection life insurance provides added security, ensuring your family can keep their home in case of unexpected events. Accidental death insurance is another valuable option, offering coverage tailored to specific circumstances. Many policies now come with living benefits, allowing policyholders to access funds in cases of critical illness or other emergencies, adding another layer of financial support.

Life insurance adapts to your goals, whether you’re planning for retirement, saving for college, or ensuring your business is protected with key person insurance. Speak with a licensed insurance agent today to discover flexible options that align with your family or business needs. Request a free quote now and take the first step toward a secure tomorrow.

With level term insurance policy, the expense of the insurance will remain the same (or potentially reduce if dividends are paid) over the term of your policy, generally 10 or two decades. Unlike permanent life insurance policy, which never runs out as long as you pay premiums, a level term life insurance coverage plan will certainly end at some point in the future, normally at the end of the period of your degree term.

How Does Term Life Insurance Help You?

As a result of this, many individuals make use of long-term insurance coverage as a stable economic preparation tool that can offer several demands. You might have the ability to convert some, or all, of your term insurance during a set duration, commonly the very first one decade of your policy, without requiring to re-qualify for protection also if your health has transformed.

As it does, you may desire to include to your insurance coverage in the future - Level benefit term life insurance. As this occurs, you might want to at some point minimize your death advantage or think about transforming your term insurance to a long-term plan.

Long as you pay your premiums, you can rest simple understanding that your loved ones will receive a death benefit if you die throughout the term. Many term plans allow you the capacity to convert to permanent insurance policy without needing to take another health exam. This can enable you to capitalize on the added advantages of a long-term policy.

Level term life insurance policy is among the simplest paths into life insurance policy, we'll discuss the benefits and disadvantages so that you can select a strategy to fit your demands. Degree term life insurance coverage is the most common and basic form of term life. When you're trying to find short-term life insurance policy plans, level term life insurance is one path that you can go.

The application process for degree term life insurance policy is typically very simple. You'll complete an application that includes basic personal details such as your name, age, etc as well as an extra in-depth survey regarding your case history. Depending upon the policy you have an interest in, you might have to join a medical exam procedure.

The brief answer is no., for example, let you have the comfort of death advantages and can build up money worth over time, suggesting you'll have more control over your benefits while you're alive.

Why Increasing Term Life Insurance Matters

Riders are optional stipulations contributed to your policy that can offer you extra benefits and protections. Riders are a wonderful method to add safeguards to your policy. Anything can occur throughout your life insurance policy term, and you intend to be prepared for anything. By paying simply a little bit more a month, cyclists can supply the support you need in instance of an emergency situation.

This rider supplies term life insurance policy on your youngsters with the ages of 18-25. There are instances where these benefits are constructed into your plan, but they can additionally be offered as a different addition that needs added payment. This cyclist gives an extra survivor benefit to your beneficiary needs to you die as the outcome of an accident.

Latest Posts

One Life Final Expense

Funeral Insurance Rates

Instantly Compare Life Insurance Online