All Categories

Featured

Table of Contents

If George is identified with a terminal disease during the very first policy term, he most likely will not be qualified to restore the plan when it expires. Some policies supply ensured re-insurability (without evidence of insurability), however such attributes come with a higher price. There are a number of sorts of term life insurance policy.

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations (life insurance with living benefits brokers). Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow.

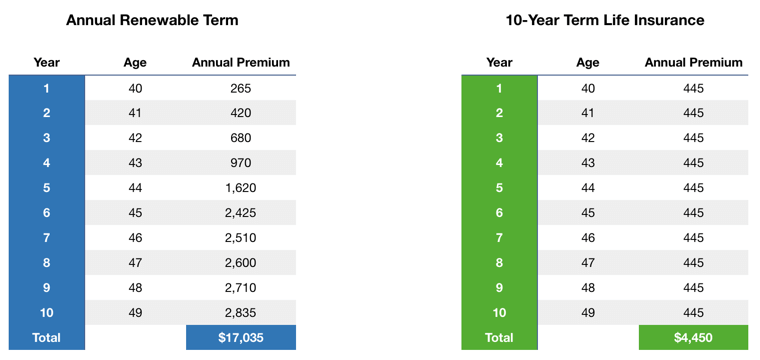

Typically, most companies use terms varying from 10 to thirty years, although a couple of offer 35- and 40-year terms. Level-premium insurance coverage has a set monthly repayment for the life of the plan. Most term life insurance policy has a level premium, and it's the kind we've been referring to in a lot of this write-up.

Term life insurance policy is appealing to youths with kids. Parents can obtain substantial insurance coverage for an affordable, and if the insured dies while the policy is in effect, the family members can rely on the survivor benefit to replace lost earnings. These policies are likewise well-suited for individuals with growing family members.

What Exactly is Term Life Insurance For Couples Policy?

The appropriate choice for you will depend on your needs. Here are some points to think about. Term life policies are ideal for people who want significant insurance coverage at an inexpensive. People that possess whole life insurance coverage pay more in premiums for less insurance coverage yet have the safety of understanding they are shielded for life.

The conversion cyclist need to permit you to transform to any type of long-term plan the insurance provider uses without limitations. The primary attributes of the motorcyclist are maintaining the original health and wellness ranking of the term policy upon conversion (also if you later have health and wellness issues or come to be uninsurable) and determining when and just how much of the insurance coverage to transform.

Of course, general premiums will certainly enhance dramatically considering that entire life insurance policy is much more expensive than term life insurance. Medical conditions that develop throughout the term life duration can not cause costs to be boosted.

What Exactly Is Level Term Vs Decreasing Term Life Insurance Coverage?

Term life insurance policy is a reasonably low-cost means to offer a round figure to your dependents if something takes place to you. It can be a good choice if you are young and healthy and balanced and support a family members. Entire life insurance policy comes with significantly greater monthly costs. It is suggested to give insurance coverage for as long as you live.

Insurance companies established an optimum age restriction for term life insurance coverage policies. The premium likewise rises with age, so an individual matured 60 or 70 will pay significantly more than a person years more youthful.

Term life is somewhat similar to automobile insurance policy. It's statistically unlikely that you'll need it, and the costs are money down the drainpipe if you do not. Yet if the most awful takes place, your family will get the benefits (20-year level term life insurance).

What is Term Life Insurance Coverage?

For the many part, there are two sorts of life insurance policy strategies - either term or permanent strategies or some mix of both. Life insurance providers use numerous types of term strategies and typical life plans along with "rate of interest delicate" items which have become more widespread given that the 1980's.

Term insurance policy gives security for a given duration of time. This period could be as short as one year or supply protection for a particular variety of years such as 5, 10, twenty years or to a specified age such as 80 or in some instances as much as the earliest age in the life insurance coverage mortality tables.

What Is Direct Term Life Insurance Meaning? The Complete Overview?

Currently term insurance coverage rates are really competitive and amongst the cheapest traditionally experienced. It needs to be kept in mind that it is a commonly held idea that term insurance is the least expensive pure life insurance protection available. One requires to review the policy terms thoroughly to decide which term life alternatives are suitable to satisfy your specific circumstances.

With each brand-new term the premium is boosted. The right to restore the plan without evidence of insurability is an essential benefit to you. Or else, the danger you take is that your health and wellness might wear away and you may be unable to acquire a plan at the same rates or even at all, leaving you and your beneficiaries without insurance coverage.

The size of the conversion duration will vary depending on the type of term plan purchased. The costs price you pay on conversion is generally based on your "current obtained age", which is your age on the conversion date.

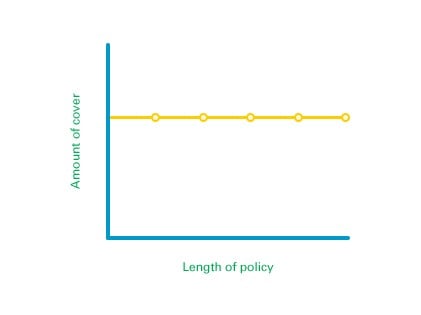

Under a level term plan the face quantity of the policy continues to be the very same for the entire period. With lowering term the face quantity reduces over the duration. The costs remains the same each year. Usually such plans are offered as home mortgage protection with the amount of insurance coverage decreasing as the balance of the mortgage decreases.

Generally, insurance companies have not can change premiums after the plan is offered. Given that such policies might proceed for lots of years, insurers should utilize conservative death, passion and cost rate price quotes in the premium calculation. Adjustable premium insurance, nonetheless, permits insurance companies to provide insurance at reduced "current" premiums based upon less conventional assumptions with the right to transform these costs in the future.

What is Term Life Insurance For Seniors? What You Should Know?

While term insurance is designed to provide security for a defined period, irreversible insurance is developed to supply insurance coverage for your whole life time. To maintain the costs price degree, the costs at the more youthful ages surpasses the actual cost of defense. This additional premium builds a book (cash money worth) which aids pay for the policy in later years as the cost of protection rises above the premium.

The insurance policy firm invests the excess costs dollars This kind of policy, which is often called money value life insurance, generates a cost savings component. Cash values are crucial to a long-term life insurance policy.

In some cases, there is no relationship in between the size of the cash worth and the premiums paid. It is the cash worth of the policy that can be accessed while the insurance policy holder lives. The Commissioners 1980 Criterion Ordinary Mortality Table (CSO) is the existing table used in determining minimal nonforfeiture values and policy books for common life insurance policy policies.

What Is Short Term Life Insurance? The Complete Overview?

Several permanent plans will certainly contain arrangements, which specify these tax requirements. There are two standard classifications of permanent insurance policy, conventional and interest-sensitive, each with a number of variants. Additionally, each group is normally offered in either fixed-dollar or variable form. Traditional whole life plans are based upon long-lasting estimates of expense, rate of interest and mortality.

Latest Posts

One Life Final Expense

Funeral Insurance Rates

Instantly Compare Life Insurance Online