All Categories

Featured

Table of Contents

nfinite banking is a financial strategy that empowers you to take control of your finances using the cash value of a whole life insurance policy. By becoming your own banker, you can leverage the cash value to fund large expenses, invest in business opportunities, or handle emergencies—all while your money continues to grow tax-free. For business owners, infinite banking is an invaluable tool for maintaining financial independence and flexibility.

Whole life insurance policies designed for infinite banking offer stability and predictability, ensuring steady cash value growth over time. instant life insurance quotes from an agent. Policies with living benefits further enhance their appeal, offering access to funds for critical illnesses or other urgent needs. Whether you’re looking to finance major purchases, grow your business, or achieve financial independence, infinite banking adapts to your goals while providing long-term security

This concept is especially beneficial for individuals and families seeking flexible financial solutions or business owners aiming to optimize their cash flow. Learn more about how infinite banking can transform your financial future. Schedule a free consultation today and take the first step toward achieving complete financial control.

That commonly makes them an extra affordable option for life insurance policy protection. Some term policies might not keep the costs and fatality benefit the same with time. You do not wish to mistakenly think you're acquiring degree term coverage and after that have your survivor benefit modification in the future. Lots of people get life insurance policy protection to help economically safeguard their liked ones in situation of their unforeseen death.

Or you may have the choice to transform your existing term coverage into a long-term plan that lasts the remainder of your life. Numerous life insurance plans have potential benefits and downsides, so it's important to understand each prior to you make a decision to acquire a policy.

As long as you pay the costs, your beneficiaries will certainly obtain the survivor benefit if you die while covered. That stated, it is very important to note that the majority of policies are contestable for two years which indicates protection could be retracted on fatality, must a misrepresentation be found in the app. Policies that are not contestable typically have actually a graded fatality advantage.

Premiums are normally reduced than entire life plans. You're not secured right into an agreement for the rest of your life.

And you can not cash out your policy during its term, so you won't obtain any type of financial gain from your previous insurance coverage. Just like various other kinds of life insurance policy, the price of a level term policy relies on your age, coverage needs, work, way of living and wellness. Generally, you'll discover much more economical protection if you're more youthful, healthier and less high-risk to insure.

Reliable Level Term Life Insurance

Given that level term premiums stay the exact same for the duration of coverage, you'll recognize specifically just how much you'll pay each time. That can be a big assistance when budgeting your costs. Level term coverage likewise has some adaptability, allowing you to personalize your policy with added functions. These usually can be found in the type of motorcyclists.

You might have to satisfy specific problems and certifications for your insurance provider to enact this cyclist. There also could be an age or time restriction on the insurance coverage.

The survivor benefit is typically smaller sized, and protection typically lasts until your youngster transforms 18 or 25. This cyclist may be a much more economical method to aid guarantee your children are covered as riders can often cover numerous dependents at the same time. As soon as your kid ages out of this protection, it may be possible to convert the rider right into a new policy.

When contrasting term versus permanent life insurance policy. decreasing term life insurance is often used to, it is essential to keep in mind there are a couple of various kinds. One of the most common type of irreversible life insurance is entire life insurance policy, however it has some vital differences compared to degree term protection. Here's a fundamental review of what to think about when contrasting term vs.

Whole life insurance policy lasts forever, while term coverage lasts for a details duration. The premiums for term life insurance are typically less than entire life coverage. With both, the premiums stay the very same for the duration of the policy. Entire life insurance policy has a money worth part, where a portion of the premium may grow tax-deferred for future demands.

One of the major attributes of degree term insurance coverage is that your costs and your death benefit do not alter. You might have protection that starts with a fatality benefit of $10,000, which can cover a home loan, and after that each year, the death advantage will certainly reduce by a collection amount or percent.

Due to this, it's frequently an extra inexpensive type of level term insurance coverage., but it might not be sufficient life insurance policy for your demands.

After determining on a policy, complete the application. If you're authorized, sign the paperwork and pay your first premium.

Leading Increasing Term Life Insurance

You may want to upgrade your beneficiary info if you've had any substantial life modifications, such as a marriage, birth or separation. Life insurance can often feel difficult.

No, degree term life insurance policy doesn't have cash value. Some life insurance plans have an investment feature that permits you to build money value in time. A part of your premium payments is established aside and can earn rate of interest over time, which expands tax-deferred throughout the life of your protection.

You have some choices if you still desire some life insurance coverage. You can: If you're 65 and your protection has run out, for instance, you may desire to purchase a brand-new 10-year degree term life insurance plan.

Comprehensive What Is Direct Term Life Insurance

You might have the ability to transform your term coverage right into an entire life plan that will last for the remainder of your life. Lots of sorts of degree term policies are exchangeable. That means, at the end of your protection, you can convert some or all of your plan to whole life coverage.

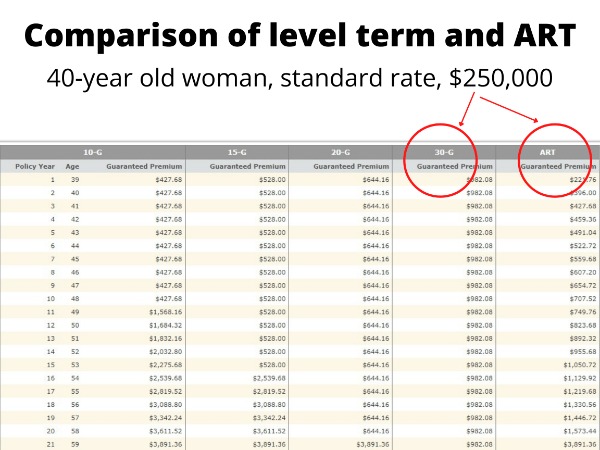

Level term life insurance coverage is a plan that lasts a set term usually between 10 and thirty years and includes a level survivor benefit and degree premiums that stay the same for the entire time the plan is in result. This means you'll understand precisely just how much your settlements are and when you'll have to make them, enabling you to budget plan accordingly.

Degree term can be a terrific option if you're seeking to purchase life insurance coverage for the very first time. According to LIMRA's 2023 Insurance coverage Barometer Study, 30% of all adults in the United state need life insurance and don't have any type of kind of policy. Degree term life is predictable and budget-friendly, which makes it among one of the most preferred kinds of life insurance policy.

Latest Posts

One Life Final Expense

Funeral Insurance Rates

Instantly Compare Life Insurance Online